Tracking user trust, platform utility, satisfaction, and loyalty ahead of the 2024 election.

Inflation Blues: Cost-Cutting is Causing a Major Mood Deficit

The following contains excerpts from our recent Inflation Nation report. Check out the full report here: Inflation Nation 2024.

When we released our first report on inflation in 2022, inflation rates were climbing to their peak of 9.1%. As of April 2024, they’ve dropped to 3.5% — significantly lower than that peak, but not quite at the pre-pandemic level of ~2%. As a result, the third installment of our inflation report, Inflation Nation 2024, found that people are cutting back on life’s pleasures, contributing to negative feelings about their finances and the economy at large.

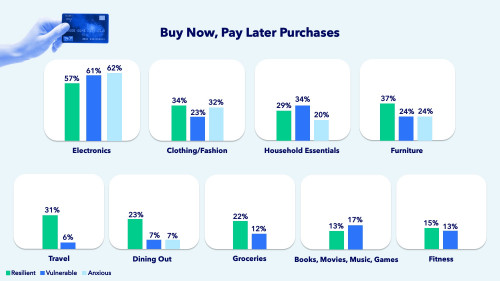

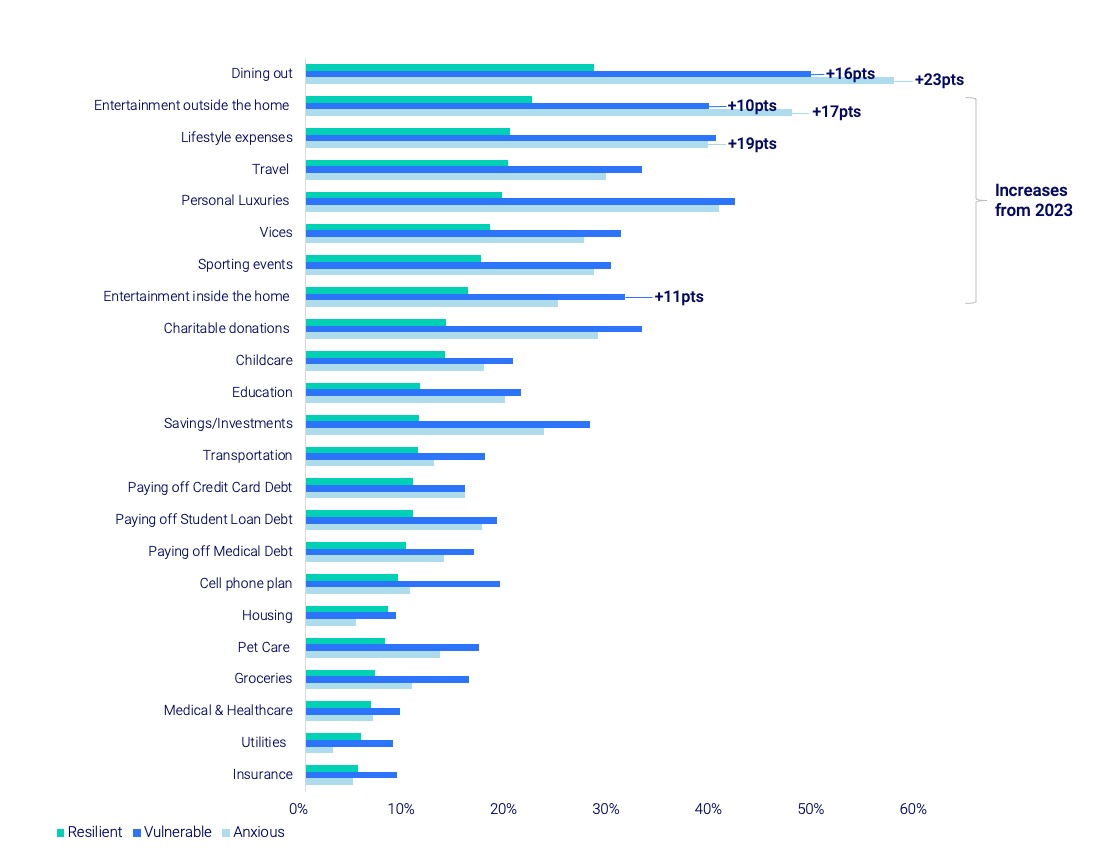

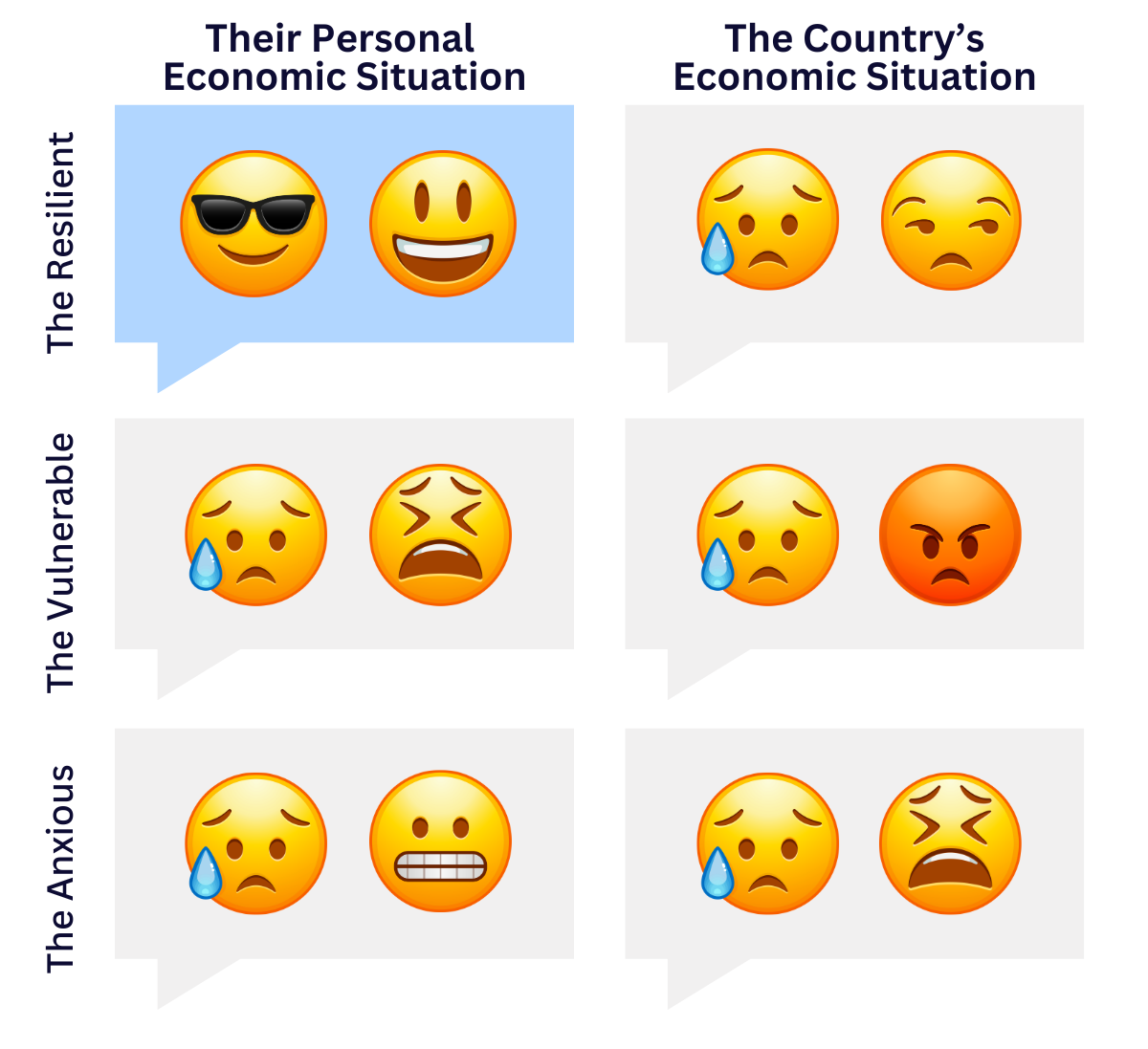

But while everyone is experiencing inflation, people aren’t feeling the pinch equally. We’ve grouped respondents into three segments based on attitudes about inflation and spending behavior: The Resilient, financially stable and more likely to stick to business-as-usual spending habits, The Anxious, who are mostly feeling the pain on paper, and The Vulnerable, who are financially unstable. And whether out of worry or necessity, it’s the “fun stuff” that tops overall spending cuts across all groups.

Spending Cuts by Segment

How People Feel About…

Mindful spending replaces revenge spending

Last year’s wave of “revenge spending” seems to be over now that people have caught up on missed experiences. While many enjoyed indulging in the activities that were limited by pandemic restrictions, like travel and concertgoing, the still-high prices of everything from gas to dining out are causing people to cut back on personal luxuries. Overall, more than half of respondents from both the Anxious (62%) and Vulnerable (61%) segments told us they are cutting back on things they enjoy in order to save (vs. just 27% of the Resilient).

When it comes to dining out, 49% of the Vulnerable and 57% of the Anxious segments are cutting back significantly (vs. 28% of the Resilient). Entertainment outside the home (39% of the Vulnerable and 47% of the Anxious) and personal luxuries (42% of the Vulnerable and 40% of the Anxious) also top the chopping block list.

What brands can do

To capture the attention of cautious spenders, brands need to amplify their value proposition. Now more than ever, it’s important that loyalty programs get creative to win price-conscious consumers. Crafting compelling, value-driven messages that soothe their concerns is also crucial. Overall, a strategic blend of reassurance and perceived worth may coax even the most budget-conscious shoppers to indulge a little more.

Address the mood deficit by uplifting and empowering your audience

In a contentious election year where the economy is top of mind, trust in government is at an all-time low and people are cutting back on fun expenditures, brands can offer a much-needed mood boost, not just by helping people maximize the value of their spend, but also through creating fun, optimistic and awe-inspiring messages and experiences.

- For example, a CPG brand could sponsor positivity-focused podcasts that would appeal to all our segments and create a series of positive self-talk/affirmation recordings that help people start each day off on the right foot.

Source: Horizon Media, Inflation Nation 2024: The Status of the American Dream and How Brands

Can Help, March 2024