The brands and industries poised to struggle or succeed in the new GLP-1 world.

Inflation Draws Both Financially Resilient and Vulnerable To ‘Buy Now, Pay Later’

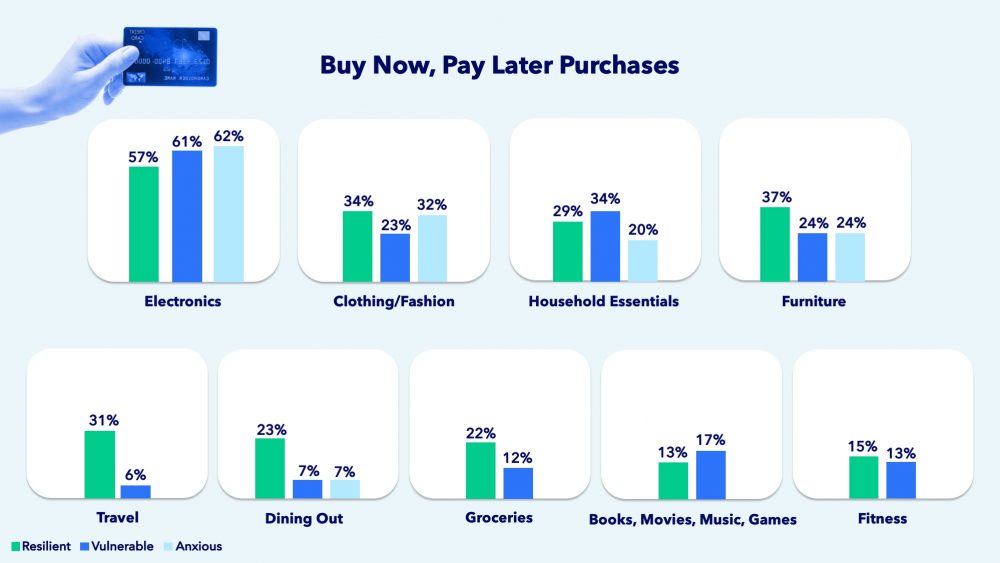

For some, cutting back in a time of inflation means paying later — even among the most financially resilient.

When we released our first report on inflation last year, we showed that not everyone was feeling the pinch equally, so we grouped our respondents into three segments based on attitudes about inflation and spending behavior: The Resilient, The Vulnerable, and The Anxious. This year, we found that people are easing up on spending restrictions, but savings have stagnated.

While only a small share (10%) of all our respondents reported making buy now, pay later (BNPL) purchases, we found similar behaviors between our two most opposing groups: The Resilient and The Vulnerable. Using buy now, pay later on items both big and small could lead to people paying off grocery expenses months down the line, or paying interest on vacation costs making it even more expensive. All of this can potentially negatively impact credit scores.

Click ‘Download PDF’ below for the full report, Inflation Nation: One Year Later.